SOL Price Prediction: Targeting $250+ as Institutional Demand Meets Technical Breakout

#SOL

- Technical indicators show SOL trading above key moving averages with positive MACD momentum, suggesting continued upward potential

- $1.65 billion institutional investment and multiple ETF filings provide strong fundamental support for price appreciation

- Ecosystem expansion through partnerships and stablecoin integration enhances SOL's long-term value proposition

SOL Price Prediction

SOL Technical Analysis: Bullish Breakout Potential

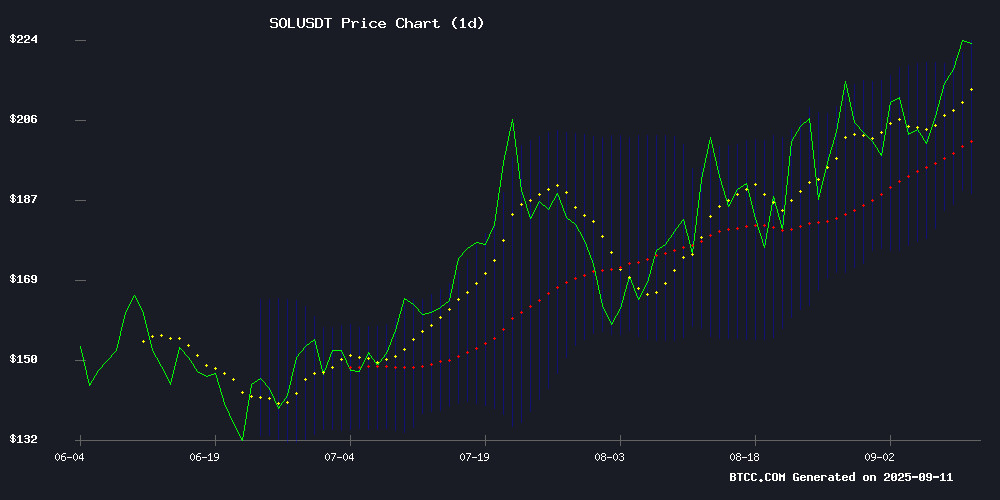

SOL is currently trading at $226.66, significantly above its 20-day moving average of $206.55, indicating strong bullish momentum. The MACD shows improving conditions with a positive histogram reading of 1.0677, suggesting potential upward momentum continuation. Price action NEAR the upper Bollinger Band at $224.90 signals strength, though traders should watch for potential resistance. According to BTCC financial analyst Robert, 'The technical setup suggests SOL could test the $240-250 range if it maintains above the $220 support level.'

Institutional Momentum Drives SOL Optimism

Significant institutional developments are fueling SOL's bullish narrative. The $1.65 billion PIPE investment backed by Galaxy and Multicoin, along with multiple ETF filings, demonstrates growing institutional confidence. Partnerships expanding Solana's treasury capabilities and stablecoin integration further strengthen the ecosystem. BTCC financial analyst Robert notes, 'The combination of institutional capital inflow and ecosystem expansion creates a fundamentally strong backdrop for SOL's price appreciation, supporting the technical breakout thesis.'

Factors Influencing SOL's Price

Forward Industries Soars on $1.65B Solana-Focused PIPE Backed by Galaxy and Multicoin

Forward Industries (FORD) surged 13% in pre-market trading after announcing a $1.65 billion private investment in public equity (PIPE) financing. The deal, led by crypto heavyweights Galaxy Digital, Jump Crypto, and Multicoin Capital, signals strong institutional confidence in Solana's ecosystem.

The financing round saw participation from Bitwise Asset Management, Borderless Capital, and FalconX, among others. Forward plans to allocate the capital toward strengthening its digital asset treasury, with Solana positioned as a core holding. This move comes as institutional interest in layer-1 blockchains reaches new highs.

Market observers note the timing aligns with Solana's resurgence in developer activity and DeFi TVL growth. The PIPE represents one of the largest single crypto-focused investments in a publicly traded company this year.

Sharps Partners with Pudgy Penguins to Expand Solana Treasury

Sharps Technology, a leading Solana digital asset treasury firm, has forged a strategic partnership with Pudgy Penguins, a prominent Web3 brand, to amplify exposure and engagement within the Solana ecosystem. Pudgy Penguins, often likened to the "Mickey Mouse of crypto," boasts over 220 billion content views and collaborations with giants like Walmart and NASCAR. The partnership will integrate Pudgy Penguins' intellectual property into Sharps' institutional-grade Solana treasury, unlocking new avenues for adoption.

Luca Netz, CEO of Pudgy Penguins, emphasized the collaboration's role in bridging the brand to institutional investors while spotlighting Solana's growth. "Verticalizing attention is core to our thesis," Netz stated, highlighting the synergy with Sharps' forward-looking approach. James Zhang of Sharps echoed the sentiment, framing the alliance as a gateway for broader participation in digital assets.

The move follows Sharps' recent efforts to bolster Solana's institutional footprint, signaling accelerating convergence between crypto-native brands and traditional finance.

Can Solana Crypto Hold $200 Amid Whale Selling Pressure?

Solana's SOL price has surged from $97 in April to $223.52 by September 11, forming a converging ascending wedge pattern. The current rejection at the wedge's upper border suggests a potential pullback toward $200, a critical support level.

On-chain data reveals significant whale activity, with wallet CMJiHu depositing 527,590 SOL ($117.5 million) into exchanges over 16 hours. Such large deposits often precede sell-offs, raising concerns of increased supply pressure. A breakdown below $200 could confirm a bearish trend reversal.

Despite selling pressure, the Solana price chart remains at a key inflection point. The next moves—whether a rejection toward $200 or a breakout toward $258—will determine the short-term trajectory for SOL.

Forward Industries Raises $1.65B to Grow Solana Holdings

Forward Industries has secured $1.65 billion in a private placement to bolster its Solana (SOL) treasury, marking one of the largest corporate raises for a crypto asset strategy. The funding round was led by heavyweight investors Galaxy Digital, Jump Crypto, and Multicoin Capital.

The capital will fuel the company's aggressive pivot toward accumulating SOL and deepening its involvement in the Solana ecosystem. This strategic allocation signals growing institutional confidence in Solana's infrastructure and long-term viability as a blockchain platform.

By positioning itself as a major holder of SOL, Forward Industries emerges as a consequential player in crypto asset management. The move reflects broader trends of institutional capital flowing into select digital assets with strong ecosystem fundamentals.

Scam Crypto Tokens Surge Following Charlie Kirk's Death

Charlie Kirk, the conservative activist and founder of Turning Point USA, was assassinated on September 10, 2025, during a public event in Utah. The tragedy has sparked political outrage, with President Trump calling it a "dark moment for America." Meanwhile, the crypto market has responded with a wave of opportunistic meme tokens capitalizing on the event.

DexScreener data reveals multiple "Justice for Charlie" tokens, some surging over 10,000% within 24 hours. Solana-based tokens like "RIPCharlieKirk" and "JusticeforCharlie" briefly reached multi-million-dollar market caps before experiencing extreme volatility. One creator reportedly profited $300,000 in an hour from these speculative assets.

The trend has drawn sharp criticism from observers who condemn the exploitation of tragedy for financial gain. Justin Wu, a prominent crypto commentator, lamented the ethical decay in certain corners of the industry, particularly among Solana memecoin developers.

Meme Tokens Surge and Crash Following Charlie Kirk Shooting

The cryptocurrency market witnessed a speculative frenzy following the tragic shooting of U.S. conservative activist Charlie Kirk. Meme-style tokens bearing his name, such as RIPCharlieKirk and JusticeforCharlie, saw astronomical gains within hours of the incident. The RIPCharlieKirk token, launched on the Solana-based platform pump.fun, skyrocketed by over 53,000%, with its market cap ballooning from under $22,000 to more than $5 million in just 45 minutes.

Another token, JusticeforCharlie, surged more than 32,000%, reaching a $7 million market cap. However, these gains were short-lived as early buyers cashed out, leading to sharp declines. The volatile nature of political-themed meme coins was once again laid bare, with dozens of copycat tokens flooding the market and exacerbating price swings.

Speculative trading dominated the action, highlighting the risks associated with such assets. The episode underscores the crypto market's propensity for rapid, sentiment-driven movements, particularly around high-profile events.

BlockchainFX Emerges as Leading Crypto Presale Contender Amid Bull Market Frenzy

The 2025 bull market is witnessing unprecedented capital flows into crypto presales, with BlockchainFX, Remittix, and Snorter Token emerging as frontrunners. While Remittix specializes in PayFi solutions and Snorter Token capitalizes on Solana's meme coin hype, BlockchainFX distinguishes itself through ambitious super app development.

BlockchainFX has secured $7.1 million from 8,800+ investors at $0.023 per token, projecting a 100% return at its $0.05 launch price. Analyst forecasts suggest potential valuations reaching $1 near-term and $5 long-term, drawing comparisons to Binance and Coinbase's early growth trajectories.

The platform's disruptive potential lies in its unified architecture combining crypto, stocks, forex, ETFs, and commodities - a first in decentralized finance. This comprehensive approach positions BlockchainFX as a potential category leader in the evolving digital asset ecosystem.

Pump.fun Token Surges 42% Amid Growing Ecosystem Momentum

Pump.fun's native token PUMP has rallied 42.34% this week, trading at $0.005814 with a $2.06 billion market cap. The memecoin launchpad platform generated $2.57 million in daily revenue, trailing only Hyperliquid among top protocols.

MEXC's recent listing of Solana-based memecoin TBCN—originating from Pump.fun—signals expanding ecosystem influence. The platform's 0.05% fee structure continues attracting new projects while buybacks and protocol revenues bolster investor confidence.

Trading volume spiked 89% to $500 million as bulls test the $0.0069 resistance level. Market participants now weigh whether the token can sustain momentum after its parabolic move.

World Liberty Financial's USD1 Stablecoin Expands to BonkFun and Raydium

World Liberty Financial, a DeFi project backed by the Trump family, has launched Project Wings to drive adoption of its USD1 stablecoin on Solana. The initiative focuses on enhancing liquidity through new trading pairs on Bonk.fun and Raydium, two prominent platforms in the Solana ecosystem.

Raydium, a decentralized exchange and automated market maker, will provide infrastructure support for the campaign. Bonk.fun, a meme coin launchpad, will host USD1 trading pairs, tapping into its $264.90 million market cap ecosystem. The move signals WLFI's ambition to capture Solana's active user base.

The project emphasizes trader-centric design, with USD1 positioned as a liquidity hub for Solana-based assets. This expansion follows growing institutional interest in stablecoin utility across decentralized finance platforms.

Solana ETF Filings and Institutional Demand Fuel 24% Monthly Rally

Solana's SOL token surged 24% in the past month as institutional interest reaches fever pitch. Seven major asset managers including Fidelity and VanEck have filed for spot Solana ETFs, with SEC decisions due by October 10. Approval would open floodgates for traditional market exposure.

Forward Industries secured $1.65 billion from crypto heavyweights Galaxy Digital and Multicoin Capital to build a SOL staking vehicle. CME's Solana futures open interest hit a record $1.49 billion, signaling growing institutional participation. The network's upcoming upgrade promises to slash transaction finality from 12 seconds to 150 milliseconds.

Technical charts show a widening triangle pattern with potential targets between $280-$350. At $216 with a $116 billion market cap, Solana continues to cement its position as Ethereum's most formidable competitor in the smart contract arena.

WLFI Launches Project Wings to Boost Stablecoin Use on Solana

World Liberty Financial (WLFI), with backing from former U.S. President Donald Trump, has unveiled Project Wings in collaboration with Bonk.fun and Raydium. The initiative incentivizes trading of USD1 stablecoin pairs on Bonk.fun, aiming to drive adoption and liquidity within Solana's ecosystem.

Promotional rewards are central to the strategy, targeting both retail and institutional participants. The partnership underscores Solana's growing role in decentralized finance, offering low-cost access to dollar-pegged assets.

How High Will SOL Price Go?

Based on current technical indicators and fundamental developments, SOL shows strong potential to reach the $250-280 range in the near term. The combination of breaking above key resistance levels, positive MACD momentum, and substantial institutional investment creates a compelling bullish case.

| Target Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $240-250 | High | 2-4 weeks | Technical breakout, ETF momentum |

| $260-280 | Medium | 4-8 weeks | Institutional adoption, ecosystem growth |

| $300+ | Low | 3-6 months | Broad market rally, sustained demand |